I am certain we have all heard of the new GREEN MOVEMENT that will eliminate the use of all fossil fuels, this includes all fuels that use oil, natural gas and coal. That would make our transportation dependent on sun and wind primarily…

Market Update

1031 Exchanges

SOLD: Twin City Mall

SOLD: Dairy Queen

SOLD: Chauvin Grocery

SOLD: Retail Center on Louisville Ave

1325 Louisville Avenue - Monroe, LA

SHOPPERS PLAZA at 1325 Louisville Ave., Monroe has been sold for $2,123,000. This retail center is occupied by Affinity and KW Realty and runs from Louisville Ave. thru to Hudson Lane. The 28,800 sf sold for $73.71 psf.

SOLD: Dollar General

The Dollar General store sold at 4540 Whites Ferry Road in West Monroe, LA on 10/1/2018 for $1,396,000. The Seller was HP Investments, LLC and the Buyer was Dankbar Properties, LLC.

SOLD: Walmart Shadow Center

The retail strip center at the corner of Louisville Avenue and Washington Street in Monroe, Louisiana sold on October 11, 2018 for $1,650,000. The Seller was Monroe Plaza LLC and the Buyer was Jakoil Co LLC.

Alternative Investments

Most of us will become real estate investors at some point in our lives. We may not own apartments, a retail center or even a commercial building but the largest investment we will ever own will be a home. In that definition most of us will invest in real estate. We will love our investment for a while but in time we will probably decide to sell. At that point you will discover that real estate is not a ‘liquid investment’. A term used to define an investment that you cannot immediately sell.

Unlike stocks, mutual funds or many other investments real estate is not a ‘liquid asset’. I, like you, have heard the stories of a home that sells in 24 hours, but that is a rare exception. As a general rule a real estate investment will take 3 months to 2 years to find a buyer at an acceptable price. I have seen too many sellers reject an early offer thinking a better offer is around the corner only to wait many, many months for another offer that may be lower than the original offer. I advise sellers that neither they nor I will set the final price but the market will tell us what it is willing to pay and that applies to homes as well as commercial and investment property.

Stock brokers and financial advisors will often refer to real estate as an ‘alternative asset’. That means that it is an investment they do not sell. However many will admit that it needs to be a part of any prudent investors portfolio. Real estate is a long term investment that has a proven track record of growing in value over time. I have seen it all but the worst cases I have witnessed are real estate investors who want a quick sale after purchase with little or no improvements.

ON THE LOCAL SCENE

The PHYSICAL THERAPY CLINIC at 2601 Ferrand Street, Monroe has been sold. The 7,800 sf building plus 36 Mini Storage Units sold for $630,000

The CREEKS APARTMENT COMPLEX 1220 E. Kentucky Ave., Ruston has sold for $3,850,000. The 24 units sold for $160,416 per unit.

—Bill Roark

***PUBLISHED in the Ouachita Citizen on November 15, 2018***

The Mid Term Elections

By the time you read this the mid-term elections will have been decided. The people have spoken and we will all live with the verdict whether we agree or not. That is what we do in a democracy. The question remaining is how it will affect our lives, our businesses, our investments and our fortunes. I remember when we watched the election of Jimmy Carter as the 39th president of the United States and how I was surrounded that night in 1977 by friends from Georgia who were elated and how my hopes had been dashed followed by a mild but short depression. As it turned out I was right- they were wrong but we all survived those years. I am confident we will do the same this time regardless of the outcome.

How this election will affect real estate values and the broader real estate market is the bigger question? We have grown use to a booming economy over the past 2 years and many have grown complacent and forgot the lost jobs, stagnant wages, closed factories re-opening overseas, the cost of illegal emigration and the suffocating regulations. One of the truly adverse effects of this economy and resulting stock market boom has been individuals reluctant to take money out of the market and buy homes or invest in other forms of real estate. However as we see the stock market continue to experience wildly fluctuating swings that will quickly change.

As one stock broker recently told me remember the market is fickle and often irrational in what it does. After many years watching the real estate market I have seen many fortunes made and unlike the stock market, few fortunes lost. This is why I am betting that whichever way the wind blows in this election the stock market will react with continued ups and downs and the real estate market will continue to be a stable and dependable alternative.

ON THE LOCAL SCENE

The 12 acres fronting HARVESTER DRIVE, MONROE has been sold for $100,000 to an out of town investor with plans for a subsidized subdivision. The property sold for $8,333 per acre.

The former UNITED HOME HEALTH BUILDING 213 Expo Circle, West Monroe sold for $1,750,000. The 16,000sf building sold for $109 psf.

—Bill Roark

***PUBLISHED in the Ouachita Citizen on November 8, 2018***

2018 Real Estate Trends

2018 REAL ESTATE TRENDS

Move over and make way for the Millennials. As they move into their mid 20’s and 30’s, Millennials are getting better jobs and making more money. The latest housing trends show Millennials made up 34% of homebuyers last year and could account for up to 43% this year. While it seems like Millennials just showed up on the scene of home buying, the next generation (Generation Z) will be hitting the post-college housing market by 2020.

We all remember the housing market crash between 2007 and 2009. During that time, over 10 million people were pushed into foreclosure. As these people re-enter the housing market, they are being called “Boomerang Buyers” and over 1.5 million are predicted to come back this year.

“Crowdfunding” and “Peer-to-Peer Lending” are the new buzzwords of the investment world. This segment, called “fractional investing”, allows a large number of people to each contribute a small amount of money towards the same investment or loan. With a number of popular websites gaining momentum, this group looks ready to make an impact on the real estate financing scene in the near future.

Smart home technology is moving in. Homeowners across all generations have shown some level of interest, but one in four Millennials are already using at least one smart home product in their home.

Of course, the two most important trends to track in any housing market are price and volume. So far this year, Ouachita Parish median home sale prices are up three percent to $170,000 and total sales volume is on pace to hit $255 Million.

I hear economists refer to the national housing market all the time, but what makes up our local housing market? In case you didn’t know, Ouachita Parish contains 68,000 dwellings including apartments and houses with 40% being rental units. The rate of new home construction has been averaging over 500 homes per year, but is currently down and on pace to hit 300 homes in 2018. (Source: U.S. Housing and Urban Development & Census Bureau).

ON THE LOCAL SCENE

RETAIL CENTER at 2770 Louisville Avenue, Monroe sold for $1,650,000 ($171 per square foot).

BLUE CROSS BLUE SHIELD OF LOUISIANA purchased a majority share in Vantage Health Plan including the Monroe Surgical Center at 2516 Broadmoor Blvd, Monroe.

Ryan Roark, CCIM is the Owner and Managing Broker of Tri State Properties. He may be contacted at 318-348-5815.

***PUBLISHED in the Ouachita Citizen on November 1, 2018***

SOLD: Tower Storage on Fulton Dr.

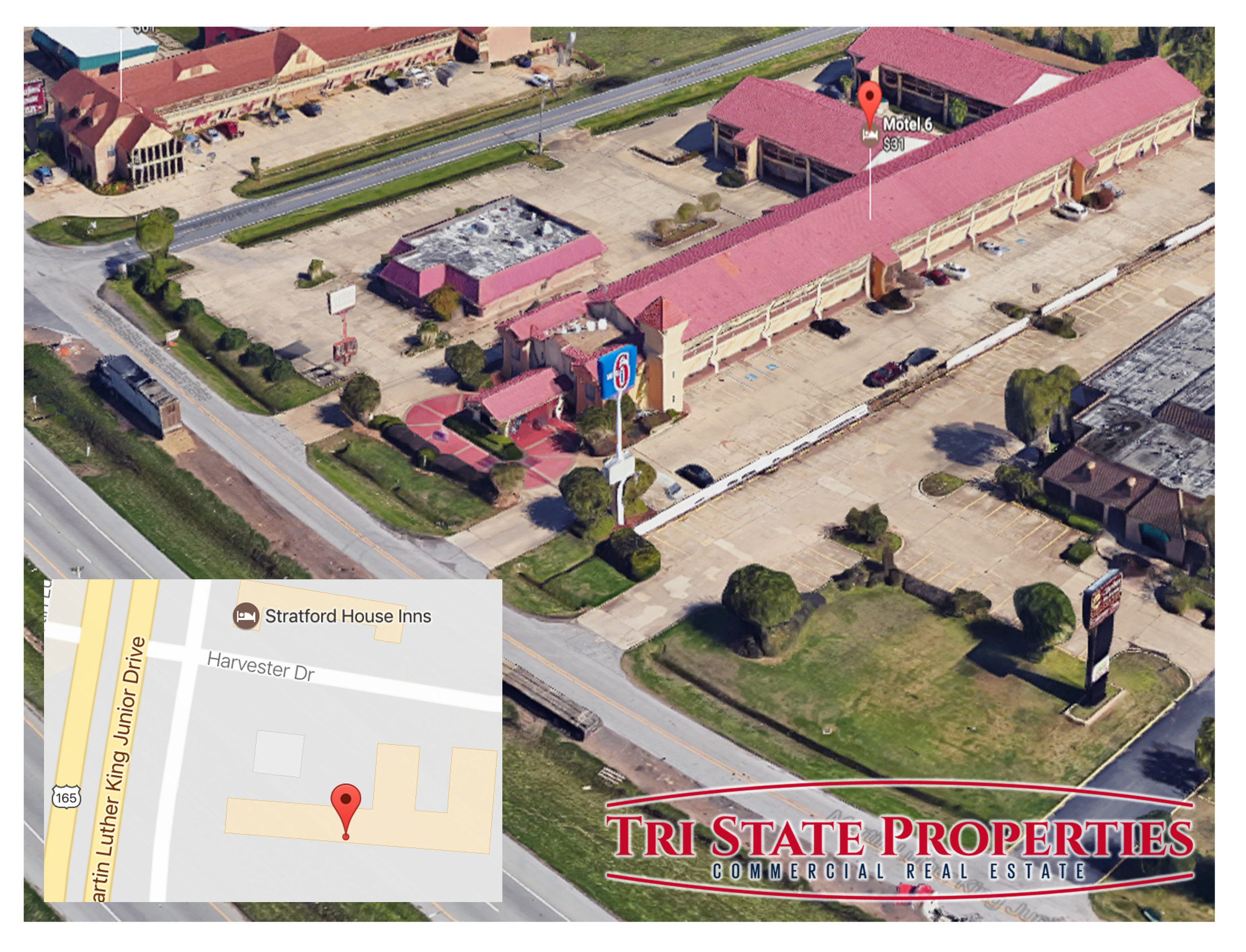

SOLD: Motel 6 on Martin Luther King Jr. Drive

Motel 6 on Martin Luther King Jr. Drive in Monroe was sold to Monroe Hospitality LLC for $1,500,000. The property is over 2 acres in size and was sold by G6 Hospitality Property LLC on March 14, 2017.